[ad_1]

In March, we launched our new Hotspots report which has been designed to discover the most well liked property markets throughout the UK based mostly on provide and demand for the properties throughout totally different areas.

Our Hotspots rating knowledge is calculated by wanting on the variety of out there gross sales properties inside a sure space and evaluating that in opposition to the amount of onsite exercise over the identical interval to create a rating that is consultant of the depth of curiosity in that market.

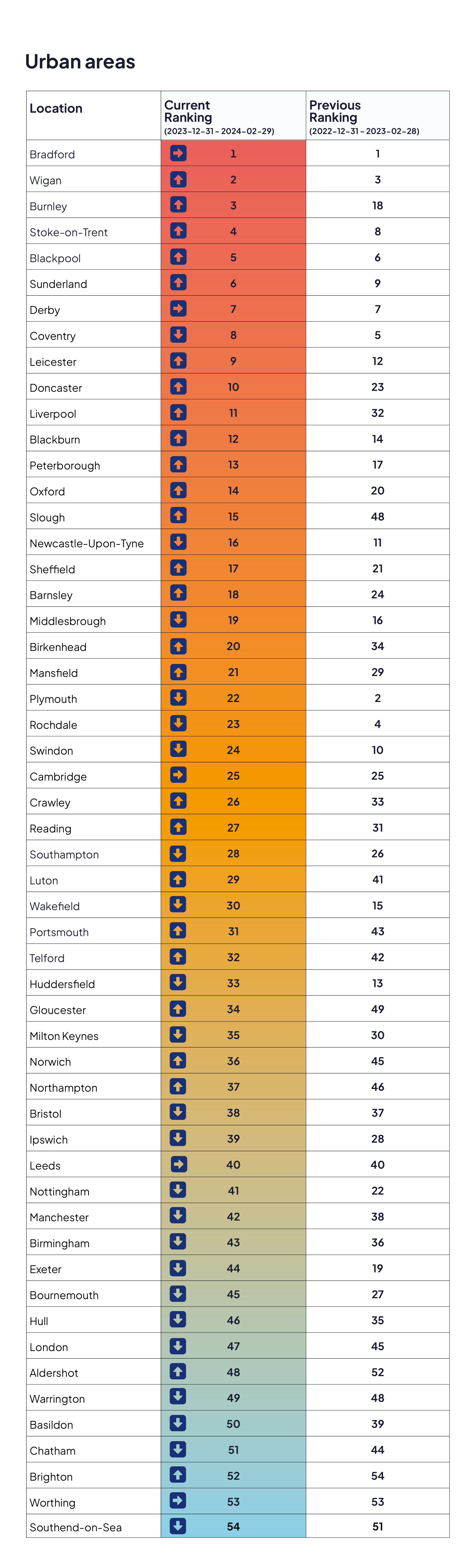

Areas are ranked by this rating and this rating is in contrast throughout totally different time intervals to indicate how the “warmth” of the market is altering over time.

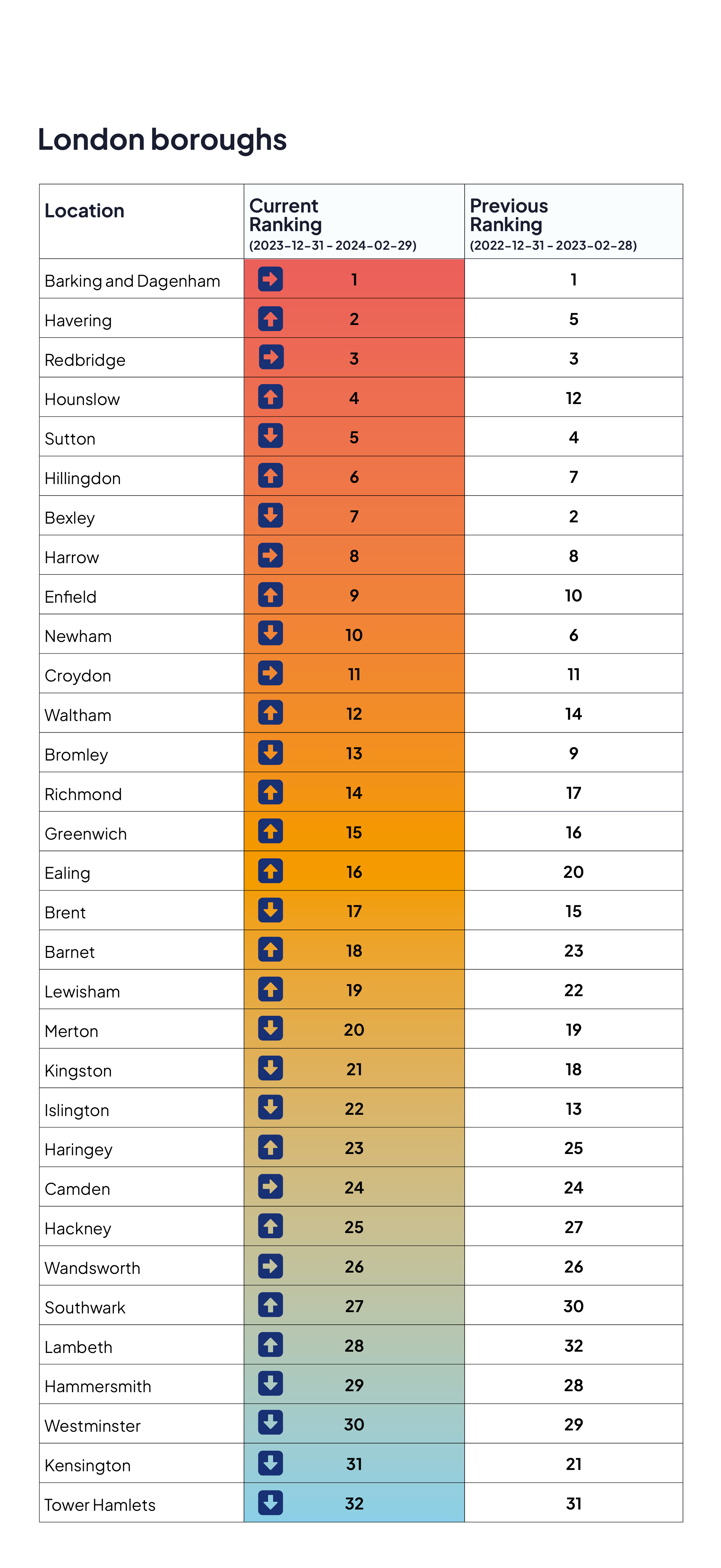

The March report confirmed that the most well liked city space within the UK within the first three months of 2024 was Bradford whereas the most well liked London borough was Barking and Dagenham.

Commenting on the report, Jason Tebb, President of OnTheMarket, says: “Many components go into shaping the choice to purchase a house in a selected space, with proximity to household and pals, work, and colleges simply a few of the many issues. As property value will increase have outstripped wage rises, affordability has more and more influenced that decision-making, particularly with excessive rates of interest and a cost-of-living disaster thrown into the combo. Making the numbers add up has not solely acutely impacted the place movers select to stay however whether or not they can purchase in any respect.

Our Market Hotspots index suggests shopping for selections are closely influenced by affordability with a few of the most cost-effective areas seeing essentially the most exercise. It’s no coincidence that the common property value in all bar one of many ten hottest city areas is under the nationwide common. There are additionally recommendations of a ripple impact at work with individuals priced out of main cities choosing cheaper city areas inside straightforward commuting distance. Therefore, Bradford, the highest hotspot for the second yr in a row, is near Leeds whereas second-placed Wigan is halfway between Manchester and Liverpool, and third-placed Burnley is north of Manchester. Put up-pandemic, individuals appear prepared to commute that little bit additional than they could have beforehand, whereas extra versatile working circumstances imply they might not be required to be within the workplace on daily basis. That is making areas exterior the key cities more and more standard with property patrons as there’s extra worth available.

The north/south divide can be in proof, with all the prime ten hottest city areas within the north of England or the Midlands. London is in a lowly 47th place, down from 45th when wanting on the identical interval final yr although common property costs haven’t risen as a lot as in different components of the nation. The index additional reinforces that many patrons are being priced out of London and the southeast and in consequence could also be in search of alternatives additional afield.

Inside London itself, it’s an identical story with the strongest buy exercise in cheaper boroughs whereas pricier boroughs will not be as busy. Barking & Dagenham is London’s hottest market, with a mean property value larger than the nationwide common however considerably decrease than lots of the costlier London boroughs. On condition that it’s a number of miles to the east of central London, commuting is easy, and concrete regeneration is providing neighborhood hyperlinks and extra inexpensive housing choices than might be discovered within the centre. In the meantime, Westminster and Kensington hover close to the underside of the desk, with common property values roughly a number of occasions the worth of these in Barking & Dagenham. With the common property value in each prime ten borough on our listing under the London common, it suggests making the leap from renting to proudly owning is extra achievable than in costlier boroughs.

Whereas a lot is manufactured from how the British are falling out of affection with shopping for property and can be glad with long-term renting, like our European counterparts, our knowledge suggests this isn’t the case. We’re a nation of aspiring householders relatively than renters, with individuals ready to gravitate to a less expensive space if it means having the ability to purchase their very own residence. If that space has good transport hyperlinks and facilities, it’s going to be standard with others in the identical place, pushing up costs over time and pricing individuals out as gentrification takes maintain.

Persons are shopping for in areas which might be comparatively inexpensive and cheaper than common within the hope that someday they might get near the common property value and even exceed it. Therein lies the chance for property patrons, with hotspots additional down the listing providing potentialities for these trying to buy however looking for higher worth and avoiding competing with fairly so many different would-be purchasers.”

[ad_2]